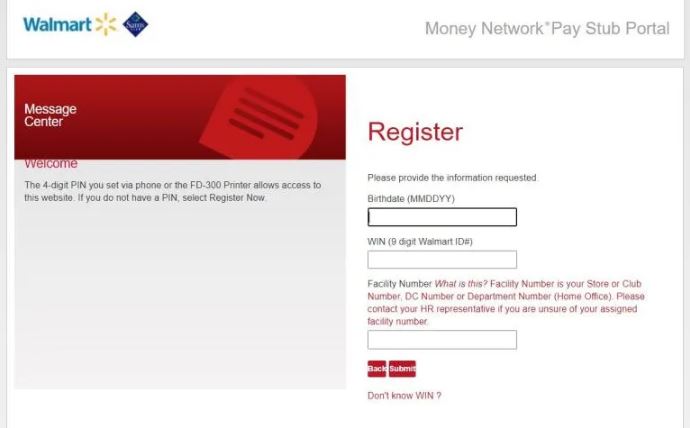

We accomplish this goal by providing our valued employees with their pay stubs and tax withholding information online.

We’ve built our company to be transparent in the hope that we might inspire others to do the same. Are DG members entitled to apply for another position if they are selected?ĭollar General has always been a big supporter of the independent workforce.Will I have to assess every position I apply for?.Where can I find available positions at Dollar General?.Dollar General PayStub Portal: All the Services You Need in One Place.Recovering forgotten passwords and changing the Personal Info.Step 2: Click on the official employee login.Step 1: Go to the official website of DG paystub.DG Paystub Login At Dollar General: steps for registered users at DG paystub.

0 kommentar(er)

0 kommentar(er)